首頁 >

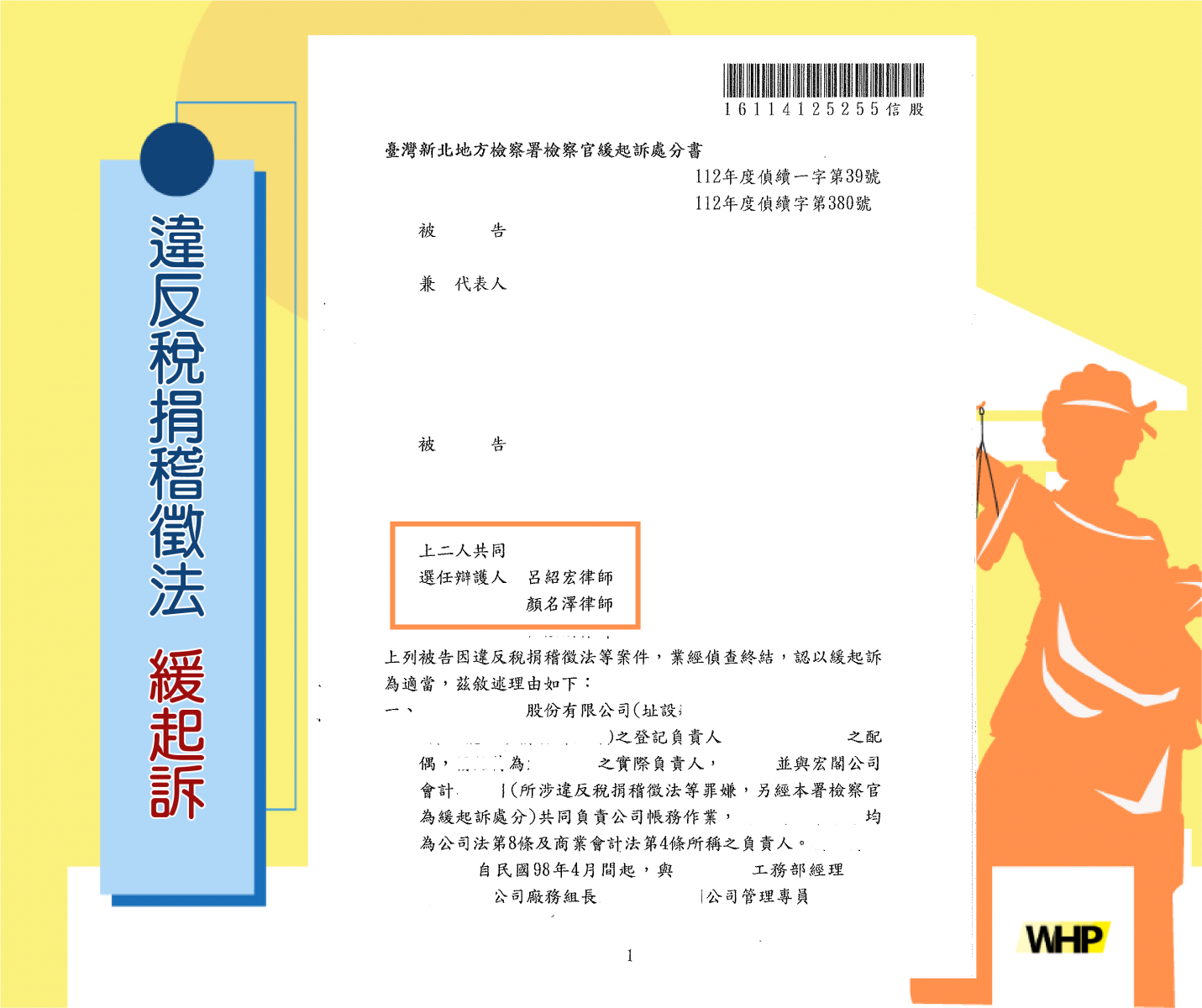

| Criminal | Defendant Accused of Tax Evasion under the Tax Collection Act Receives Non-Prosecution Disposition

Relevant Legal Provisions

Article 41, Paragraph 1 of the Tax Collection Act (prior to amendment): A taxpayer who evades taxes by fraud or other improper means shall be subject to imprisonment for not more than five years, detention, or a fine of up to NT$60,000, or both.

Article 43, Paragraph 1 of the Tax Collection Act (prior to amendment): Anyone who instigates or assists in the commission of the offenses specified in Article 41 or Article 42 shall be subject to imprisonment for not more than three years, detention, or a fine of up to NT$60,000.

Article 71, Subparagraph 1 of the Business Accounting Act: A business operator, chief accountant, accounting personnel, or any person legally entrusted to handle accounting affairs on behalf of others shall be subject to imprisonment for not more than five years, detention, or a fine of up to NT$600,000, or both, if they:

1.Knowingly prepare accounting vouchers or make entries in the books based on false information

Article 215 of the Criminal Code: A person engaged in a profession who, knowing the information to be false, records it in documents prepared in the course of business, and such documents are likely to cause harm to the public or others, shall be sentenced to imprisonment for not more than three years, detention, or a fine of up to NT$15,000.

Facts and Reasons

The defendant (our client) was registered as the responsible person for several different companies. Due to a lapse in judgment, and despite knowing that there were no actual transactions between the companies, the defendant still issued false invoices to claim deductions for business tax and corporate income tax. After the case was investigated by the Ministry of Justice Investigation Bureau, the client deeply regretted their actions and sought legal assistance from our law firm.

Prosecutor's Disposition

The investigation concerning the defendant’s violations of the Tax Collection Act and related offenses has been concluded, and it has been deemed appropriate to grant deferred prosecution.

The above facts have been fully admitted by the defendant during questioning and investigation, consistent with the testimonies provided by witnesses and supported by relevant accounting records. The defendant was informed that their confession must be consistent with the facts, and the offense has been substantiated. Upon review, the defendant has no prior criminal record and has maintained good conduct, as evidenced by a criminal record report. Considering that the offense resulted from a momentary lapse in judgment, and that the defendant has confessed truthfully, shown a positive attitude, and already repaid the evaded tax amount, it is determined that the defendant has shown genuine remorse. In light of the factors listed in Article 57 of the Criminal Code and the interest of public welfare, deferred prosecution is considered appropriate in this case.

(Some details of the case have been adjusted or omitted to protect the parties' rights.)

Attorneys: Herman Lyu、Ian Yan

-

11.25 2025

Criminal | Forgery of Documents, etc. Successfully...

-

11.18 2025

Civil Case | Defendant’s Claim for Damages Success...

-

11.11 2025

Criminal | Violation of Anti-Money Laundering Act,...

-

10.28 2025

Criminal Case | Defendant Acquitted of Hit-and-Run...

-

10.21 2025

Criminal Case | Defendant Charged with Forgery Acq...

-

10.14 2025

Assisted in the Division of Co-owned Property and ...

-

09.30 2025

Defendant – Offenses Against Sexual Autonomy Appea...

-

09.23 2025

Criminal | Defendant Charged with Embezzlement in ...

-

09.16 2025

Criminal | Case of Infringement of Sexual Privacy ...

-

09.09 2025

Request for Ownership Transfer Registration – Plai...

-

09.02 2025

Civil | Joint Construction Dispute Requesting Perf...

-

08.26 2025

Criminal | Defendant Charged with Aggravated Fraud...

-

08.19 2025

Internal Company Dispute Defendant Forged Document...

-

08.12 2025

Civil Case | Check Dishonored – Claim for Loan Rep...

-

08.05 2025

Heavy Motorcycle Rear-End Collision, Lawsuit for N...