首頁 >

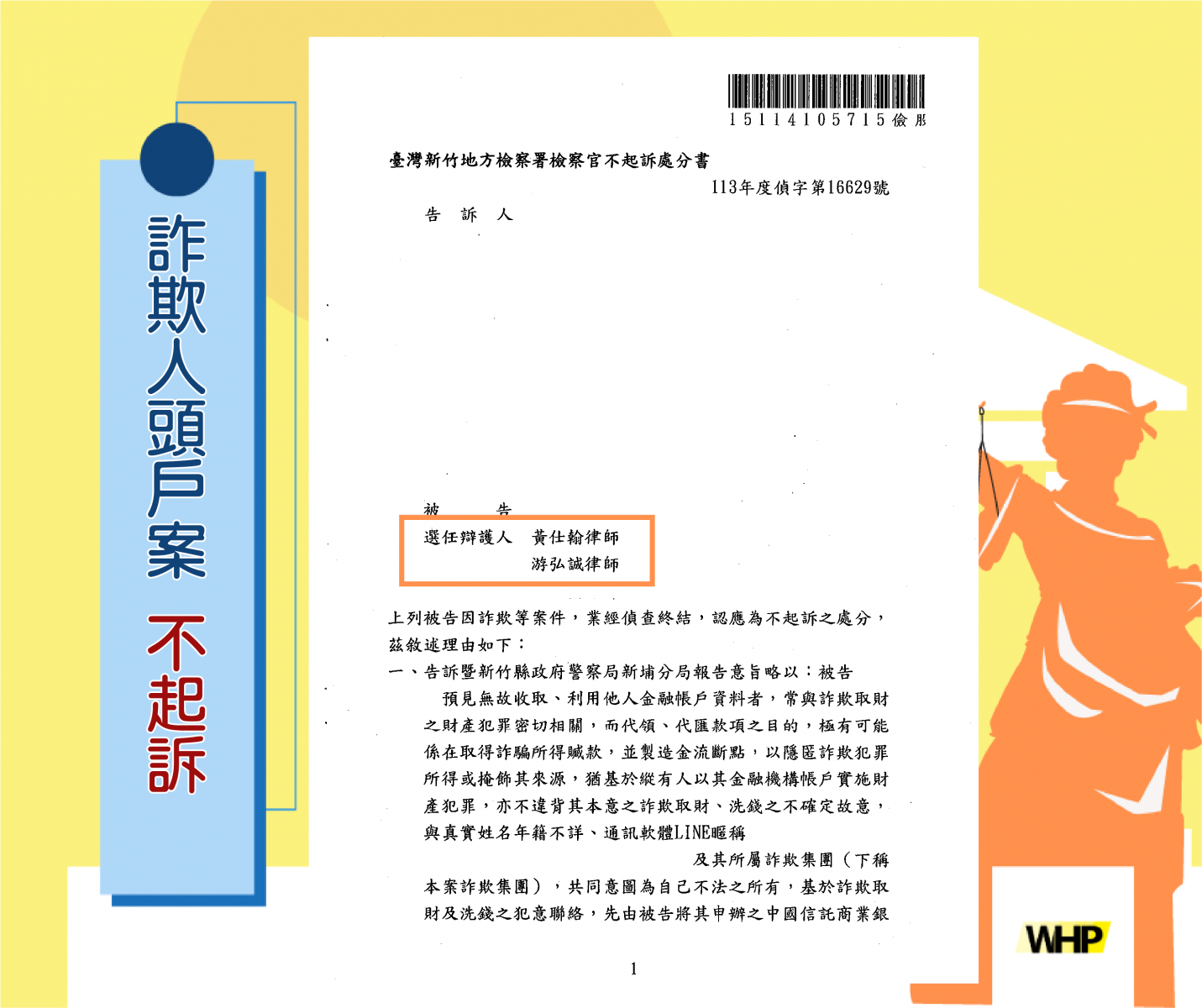

| Fraud | Job Seekers Encounter Fraud Syndicate, Dummy Account Defendant Successfully Not Prosecuted

Relevant Legal Provisions

Criminal Code Article 339, Paragraph 1: Those who, with the intent to unlawfully obtain property for themselves or a third party, use deceit to cause another person to deliver property belonging to themselves or a third party shall be punished with imprisonment for up to five years, detention, or a fine of up to NT$500,000, or both.

Article 14 of the Anti-Money Laundering Act (before amendment): Anyone who engages in money laundering behaviors listed in Article 2 shall be sentenced to imprisonment for up to seven years, and may be fined up to 5 million NTD. Attempts to commit the aforementioned crimes shall also be punished. In the two preceding cases, the penalty shall not exceed the maximum penalty prescribed for the specific crime.

Facts and Reasons

The defendant (our client) sought part-time work online, and was contacted by relevant personnel via the LINE messaging app to arrange the job. The other party falsely claimed that the defendant could handle high-paying cases and initially deceived the defendant into paying a "preparation fee." Then, they falsely claimed that due to the defendant's operational mistakes, a large compensation fee was required. As a result, the defendant took out a loan from the bank. In an effort to quickly repay the related credit loan, the defendant, under the instructions of the fraud syndicate, provided the bank account details. It was only after the bank was alerted that the defendant realized they had been scammed, but by then, they had already become a fraud defendant.

Prosecutor's Disposition

The defendants mentioned above have been investigated and concluded without prosecution for fraud-related cases.

Given the rampant occurrence of fraud in today's society and the evolving methods of deception, aside from the common practice of scamming people into transferring money through fraudulent phone calls, methods such as misusing job advertisement postings, loan application ads, or erroneous online shopping payment methods to evade law enforcement scrutiny, using the action codes and financial institution accounts, are often heard of. The public's vigilance or risk assessment of social issues varies from person to person, and there is no definite correlation with education level, occupation, or maturity of mind. Despite extensive media coverage of these fraudulent methods, many highly educated individuals still fall victim, as can be clearly seen.

Therefore, the defendants in this case provided account information simply because they were deceived by the rhetoric of a fraud group and unwittingly used by others. There are relevant dialogue records and bank transaction records throughout the process to support this claim. It is difficult to determine subjectively whether the defendants had contact with members of the fraud group with intent to commit fraud and make money, and directly connect them with such criminal charges. Furthermore, there is no other positive evidence to confirm any misconduct by the defendants, and their suspicion should be considered insufficient.

(Some details of the case have been adjusted or omitted to protect the parties' rights.)

Attorneys: Vincent Huang、Kevin Yu

-

11.25 2025

Criminal | Forgery of Documents, etc. Successfully...

-

11.18 2025

Civil Case | Defendant’s Claim for Damages Success...

-

11.11 2025

Criminal | Violation of Anti-Money Laundering Act,...

-

10.28 2025

Criminal Case | Defendant Acquitted of Hit-and-Run...

-

10.21 2025

Criminal Case | Defendant Charged with Forgery Acq...

-

10.14 2025

Assisted in the Division of Co-owned Property and ...

-

09.30 2025

Defendant – Offenses Against Sexual Autonomy Appea...

-

09.23 2025

Criminal | Defendant Charged with Embezzlement in ...

-

09.16 2025

Criminal | Case of Infringement of Sexual Privacy ...

-

09.09 2025

Request for Ownership Transfer Registration – Plai...

-

09.02 2025

Civil | Joint Construction Dispute Requesting Perf...

-

08.26 2025

Criminal | Defendant Charged with Aggravated Fraud...

-

08.19 2025

Internal Company Dispute Defendant Forged Document...

-

08.12 2025

Civil Case | Check Dishonored – Claim for Loan Rep...

-

08.05 2025

Heavy Motorcycle Rear-End Collision, Lawsuit for N...